The Relationship Between Exchange Rate and Inflation in Pakistan

by Shagufta Kashif

Abstract

There has been a long-standing interest in studying the factors that are responsible for uneven vacillation in the stable growth of the world economies. Lots and lots of theoretical literature and empirical evidences have addresses this issue in the past. Hike in prices of goods and services and foreign exchange are two important aspects which are deemed responsible for such potholed fluctuations in the economic growth

The volatility of the nature of prices is a major source of concern in all countries since 1970s. The issue is of a more serious nature in the developing countries where inflation in foreign countries known as “imported inflation” is seen to be driving “local/domestic inflation”; making domestic policies to control inflation ineffective. Similarly, in Pakistan, the domestic price level rose from the mid-1970s. The exchange rate started depreciating continuously from the early 1980s. Continuous devaluation of currency and inflation in the 1980s seems to suggest a correlation between the two variables.

The studies by Rana and Dowling (1983) suggest that foreign inflation is the most influencing factor in explaining the change in local price level in nine less-developed countries of Asia during the period 1973-79. This study suggests that these countries cannot exercise much control over domestic inflation, however, the policies of their major trading partners (through exchange rate) had a significant impact on their domestic prices. Cooper (1971) and Krugman and Taylor (1978) have also studies this relationship.

This research paper will provide the empirical evidence regarding the relationships between foreign exchange reserves and inflation, focusing on the period between 1993-2010. We will use the Ordinary Least Square model to determine the long run relationship.

Our empirical analysis does not support the results of Ahmad and Ali (1999) that a devaluation has a significant impact on inflation. We believe that their results differ from ours because they estimate a model that is based on some fairly restrictive assumptions. For example, they believe there is a complete exchange pass-through to import prices. This assumption is important for their results, but is not supported by recent theoretical models or empirical evidence.

1. Introduction

Does devaluation lead to an increase in prices? This is a critical question that policy-makers in Pakistan have faced continuously over the past three decades or so, and particularly since 1982, following the adoption of a flexible exchange rate policy. In the beginning of 1972, the exchange rate was five Pakistani Rupee to one US Dollar. After the devaluation in 1972 and a small revaluation in 1973, the exchange rate remained fixed at about ten rupees per dollar till the end of 1981. In January 1982, the exchange rate was allowed to fluctuate, eventually, rising to a rate around eighty rupees per dollar over the next two decades. This escalation involved a number of major devaluations in rupee value. Such devaluations received huge attention and often raised the concern that they would further contribute to already-rising inflation. The concern about inflation is based on the popular view, which has sometimes been voiced by experts in policymaking circles, that consumer prices are notably affected by imported goods prices, which increase speedily in response to a devaluation.

In a study on this subject, Ahmad and Ali (1999) emphasized that the “recent empirical work in Pakistan provides unswerving proof that the domestic price level responds significantly but gradually to exchange rate devaluation” (p. 237).

Inflation is, by and large, associated with monetary expansion. The case of Pakistan is not different from other countries. As a matter of fact, rise in general price level can be mapped on growth of money supply. In most of the developing economies of the world, elasticity of exchange rate is favoured on the ground that it depoliticises the problem of devaluation and creates less disruption in the economy. In the empirical literature, the exchange rate regimes are also linked to domestic prices, trade patterns and current account balance. However, “…exchange rate depreciation for a less developed country would be ineffective as an adjustment mechanism to the extent that domestic inflation persists…” [Meier (1984)].

Another adverse impact may be that real exchange rate may remain stable but in some cases lead to anti-export predisposition.

2. Literature Review

The theory of Purchasing Power Parity (PPP) emphasizes that “under free international trade, perfect information and free floating exchange rate the prices of traded goods, when expressed in a common currency, are equalised across two countries”. While at the macro level the theory envisaged a clear-cut relationship between nominal exchange rate and domestic and world price levels, there are more than one ways to express the PPP equation.

The recent event of currency devaluation and price inflation in Pakistan provides an exciting case to focus on the above issues. A widespread observation is that the practice of repeated currency devaluation is the main cause of inflation in Pakistan. This would mean that the general price level in Pakistan adjusts quickly to the traded goods prices.

In the light of this background, this paper aims to study this relationship of nominal exchange rate and domestic price level with each other and with other economic variables in a vigorous context of Pakistan. The price level and exchange rates are determined concurrently in a model that contains sufficient built-in dynamics. The recent empirical work in Pakistan provides unswerving evidence that the domestic price level responds significantly but steadily to exchange rate devaluation [Khan and Qassim (1996)], Ahmed and Ram (1991); Hassan and Khan (1994); Bilquees (1988)].

In case of Pakistan the mid-1970’s was the most inflationary time, with inflation rates averaging more than 15 percent annually. The oil price hike and nationalization of the economy greatly generated inflationary pressures of an unmatched nature.

Accommodating monetary expansion also played a greater role in invigorating inflation in the 1970’s (Jones and Khilji 1988). Currency devaluation and devastating floods, affecting agriculture production, aggravated these pressures. The role of apathy seemed manifest in this era as people do consider expected inflation while making their optimization decisions.

The trend of inflation in Pakistan remained low, compared to the other developing nations in 1980s and early 1990s. The annual average inflation rate from 1980 to 1993 was 7.4 percent, appreciably below as compared with its South Asian neighbours. The combination of improved performance of commodity (goods plus services) producing sector, lower public expenditures and turnaround of the nationalization policy played the vital role. In addition, the country has a very middle-of-the-road rate of increase in money stock when compared internationally.

The State Bank has allowed the money supply to increase by only about 15 percent annually between 1970 and 1993. The 1990’s has witnessed an end to the period of low inflation and the trend reversed towards accelerating inflation. Given Pakistan’s wide-ranging price stability during the earlier decades, the surge of prices in the 1990’s threatened to reduce the rates of return on financial assets and created a general climate of uncertainty. The whole sale price index (WPI) almost reached twenty percent by the middle of the decade, with the consumer price index (CPI) not lagging far behind. Compared to the historical level of single digits, the inflation of the 1990’s created a serious disturbance.

It was the period of liberalized policies, frequent changes of the governments, inconsistency of the policies and of nuclear explosion. Increase in procurement prices of wheat (Hassan et al. 1995), government borrowing, private sector borrowing, exchange rate depreciation and adaptive expectations were the main factors behind this surge in inflation. In the era of 2001-08, the inflation has shown a mixed trend. During 2001-04 inflation remained low but CPI shot up in 2004-05 and it reached to 9.3 percent. It dropped to 8 percent in 2005-06 but it again shoot up in 2006-08 and reached to its historical high level. Non-government sector borrowing and rise in import prices may be the factors behind it. In the long-run, certainly, the inflation is considered to be—as Friedman (1963) stated—always and everywhere a monetary phenomenon.

The causing factors of inflation in Pakistan remained inconclusive in both fiscal and monetary aspects. Heavily dependent on specifications, the varying econometric results have yet to resolve the debate. Some of the empirical studies (see for instance, Bilquees 1988; Hassan et al. 1995) found that contrary to popular perceptions about the contribution of monetary expansions and supply shocks to inflation, it was the rise in procurement prices and administered prices, as well as the increase in indirect taxes in the 1994-5 budget, that explain the spiralling inflation.

Information plays an important role to change the business scenario and it also change the expectation of the people regarding market. Therefore foreign investors require more return if risk is more to relative country. Such information is perceived from different macroeconomic variables. For example, information related uncovered interest rate can change the exchange rate and risk premium between two countries (Duartea and Stockman, 2005).

Macroeconomic variables can change the economic phenomenon as well as it leads to change the exchange rate at domestic level. Nominal or real change in the interest rate is the main important feature of the monetary policy and it reason to change the exchange rate. In addition, the positive change in real or nominal interest at domestic level can appreciate the exchange rate at domestic level and vice verse (Kim and Roubini, 2000). However, information regarding macroeconomic variables can be divided into two types whether it is strong or weak. But strong announcement of macro-economic variables reason to appreciate the exchange rate.

Although in long run there is a co movement in interest and exchange rate and this movement also leads to require the risk premium (Fausta et. al., 2007). Moreover, daily intervention by central economic authority also set the exchange rate but the benefit can be achieved for short term not for long term (Dominguez, 2006). Subsequently, economic news related macroeconomic variables like interest; inflation and monetary policy increase or decrease the value of the currency.

In addition, positive change in fundamental of the economy can appreciate the value of currency while unexpected negative change in the economic variable leads to decrease the value the domestic currency (Ehrmann and Fratzscher, 2005). Consequently, variation in inflation also changes the spot and forward exchange rate while it depends upon direction of the inflation of one country to other country. In addition, it is observed positive change in exchange rate if direction of inflation in two countries is same but domestic inflation remains low as compare to other country (Simpson et. al., 2005).

However, macroeconomic variable and exchange rate are positively correlated but it depends upon the time duration (Ray, 2008). Accordingly, inflation and interest rate both have negative relation with nominal exchange rate. However, expectation regarding real exchange rate has positive relation with nominal exchange rate (Hsing, 2007). On the other hand, thereis a co movement between interest rate and exchange rate and sensitivity depends upon the monetary structure of the relative country. The country having strong monetary structure has low co movement between exchange rate and interest rate (Holtemoller, 2005). The above literature denotes the importance of interest rate and inflation in the determining the exchange rate. The existing work also investigates the relation of inflation and interest with exchange rate. However, less work is done on this issue related to Pakistani scenario and the robust work enhances the knowledge at academic level as well as domestic level.

The monetary policy in Pakistan aims at stabilizing the domestic and external value of the currency and to foster economic growth. Therefore, the exchange rate pass-through to domestic wholesale and consumer prices is an important link in the process of monetary policy transmission. Since Pakistan’s economy has a considerable degree of openness to foreign trade, the domestic price level cannot remain immune to external price shocks i.e. exchange rate depreciation/appreciation and changes in import prices. Any appreciation or depreciation of the exchange rate will not only result in significant changes in the prices of imported finished goods but also imported inputs that affect the cost of the finished goods and services.

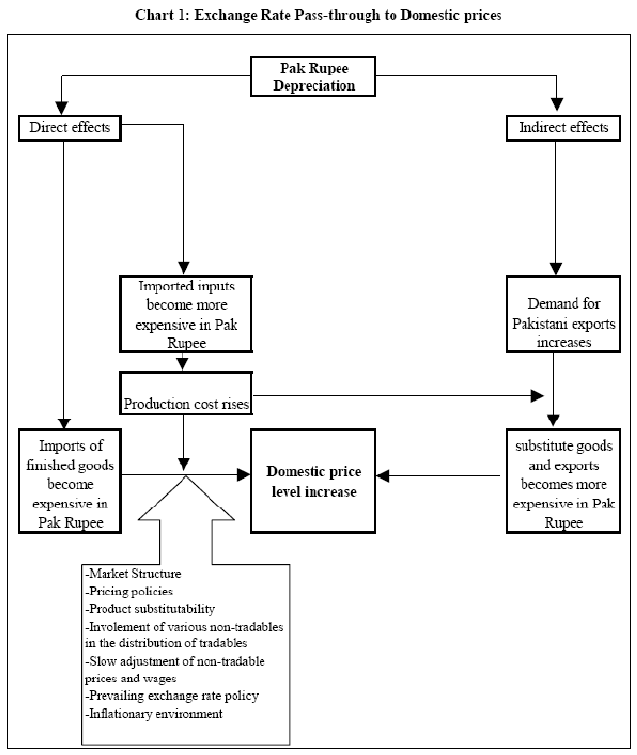

Specifically, exchange rate movements can influence domestic prices through direct and indirect channels (see Chart 1). In case of direct channel, exchange rate movements can affect domestic prices through changes in the price of imported finished goods and imported inputs. In general, when a currency depreciates it will result in higher import prices while lower import prices result from appreciation in price taker countries like Pakistan. The potentially higher costs of imported raw material and capital goods associated with an exchange rate depreciation increase marginal costs and lead to higher prices of domestically produced goods. In case of indirect effect, the exchange rate depreciation affects the net exports which in turn influence the domestic prices through the change in aggregate demand, putting upward pressure on domestic prices. In addition, import-competing firms might increase prices in response to foreign competitor price increases in order to maintain profit margins. However, the extent and the speed of exchange rate pass-through depends on several factors such as market structure, pricing policies, general inflationary environment, involvement of non-tradable in the distribution of tradable, relative share of imports in WPI and CPI basket, etc.

Eatzaz and Saima (1999) explore the relationship between nominal exchange rate and domestic price level and also their relationship with other economic variables for Pakistan by using quarterly data form 1982-II to 1996-IV. This paper traces the pattern and speed of adjustment in the two variables in response to different types of shocks. Cointegration method is used for the model estimation, the findings of the study suggest that one percent increase in price level of import, whether due to exchange rate devaluation or rising world prices, results in 0.15 percent increase in CPI.

3. Methodology

In order to find the relationship between inflation and exchange rate, a monthly data of same variables are used from 1970-2009. In addition, on the basis of previous literature, following hypothesis has been developed.

Hypothesis 1:

H0: There is no relationship between inflation and exchange rate

The following equation shows the mathematical relation of dependant and independent variable.

ER= α + β 1 (Inf) + μ i

This equation will be converted to double-log for the purpose of E-Views

Log (ER) = α + β 1 Log(Inf) + μ i

Where:

Ex. Rate= Exchange rate

Inf = Inflation

μ i = Error Term

In contemporary study, inflation in Pakistan is taken as an independent variable while exchange rate of Pak Rupee to US Dollar is taken as a dependent variable. Inflation is taken from SBP which is a reliable source at domestic level. Moreover, exchange rate is taken from (www.oanda.com). The correlation matrix is used to check the negative or positive relation of independent variable with dependant variable. In addition, OLS model is applied to check the significance of the variable at individual and collective level.

4. Results and Discussion

The analysis regarding descriptive statistics of exchange rate and inflation is shown in Table 1.

| Coefficient | Std. Error | t-Statistic | Prob. |

|---|

| α | 4.064220 | 0.288632 | 14.08100 | 0.0000 |

| β 2 | -0.059049 | 0.136605 | -0.432258 | 0.6713 |

| R-squared | 0.011543 | Mean dependent var | 3.943818 |

| Adjusted R-squared | -0.050235 | S.D. dependent var | 0.313163 |

| S.E. of regression | 0.320932 | Akaike info criterion | 0.669267 |

| Sum squared resid | 1.647962 | Schwarz criterion | 0.768197 |

| Log likelihood | -4.023401 | Durbin-Watson stat | 0.085469 |

Table 1: Source: Results from E-Views

The results shown in the above Table reveals a strong negative relation between inflation and exchange rate. The overall model is explained by 1.1% based on total observations. The inflation differential has a negative coefficient while the t-value (-0.432) shows that individually inflation doesn’t reason to change the exchange rate along with insignificant pvalue (0.6713) which is greater than 0.05.

On behalf of above mentioned results, it can be said that inflation is not the most important tool to determine the exchange rate in the Pakistani market scenario if it is compared with US currency Dollar. This means that if inflation has increasing trend, then it lead to a decrease in domestic exchange rate.

5. Conclusion

The main objective of this robust work is to find the impact of inflation on the exchange rate. On behalf of a total of 17 year’s data from 1993 to 2010, following results are found which accept the null hypothesis.

- There is an insignificant and a negative relationship between inflation and exchange rate of US $ and Pakistani Rupee.

This suggests that the argument of imported inflation may not be valid in case of Pakistan, which means that there is no evidence of a significant pass-through of rupee depreciations to consumer prices in the short-run. This finding is consistent with recent theoretical analysis that suggests that a weak short-run association between exchange rate changes and inflation.

It would appear, therefore, that concerns about the inflationary consequences of devaluation in Pakistan are somewhat misplaced. Stability of the nominal exchange rate may be desirable for many reasons, but not because of fears that exchange rate fluctuations will impose an inflationary cost on the economy. Furthermore, these results are for one foreign currency i.e., Pak Rupee and US Dollar. The exchange rate variation with respect to other major currencies can be different.

Our empirical analysis does not support the results of Ahmad and Ali (1999) that a devaluation has a significant impact on inflation. We believe that their results differ from ours because they estimate a model that is based on some fairly restrictive assumptions. For example, they believe there is a complete exchange pass-through to import prices. This assumption is important for their results, but is not supported by recent theoretical models or empirical evidence.

Moreover, lead-lag relation between interest and exchange rate can also be looked into further research.

References

- Kim S. And Roubini N. (2000), Exchange rate anomalies in the industrial countries: A solution with a structural VAR approach, Journal of Monitory Economics, Vol. 45, pp 560-587

- Rehman R, Rehman A, Raoof A., (2010), Causal Relationship between Macroeconomic Variables and Exchange rate, International Research Journal of Finance and Economics, Issue 46, (www.eurojournals.com/finance.htm)

- Hyder Z., Shah S., (2004), Exchange Rate pass-through to domestic prices in Pakistan, SBP Working papers, (www.sbp.org.pk)

- Khan R., Gill A., (2010), Determinants of Inflation: A Case of Pakistan (1970-2010), SBP Working Papers

- Khan A, Qasim M, (1996), Inflation in Pakistan Revisited, Pak Dev Rev. 35, (www.ccsenet.org/ijef)

- Khan M., A Schimmelpfennig (2006), Inflation in Pakistan: Money or Wheat, SBP Res Bull

- Chaudhry I. Et. Al., (2011), Foreign Exchange Reserves and Inflation in Pakistan: Evidence from ARDL Modelling Approach, International Journal of Economics and Finance Vol. 3, No.1, (www.ccsenet.org/ijef)

- Khan A, Bukhari K, Ahmed Q, (2007), Determinants of Recent Inflation in Pakistan, Research Report No. 66, (SPDC website)

- Agha A, Khan S, (2006) An Empirical Analysis of Fiscal Imbalances and Inflation in Pakistan, SBP Research Bulletin, Volume 2, Number 2, (SBP Website)

- Rehman M., Rehman R, (2002) Relationship of Exchange Rate with various Macro- Economic Variables, (www.ccsenet.org/ijef)

- Siddiqui R., Akhtar N., (1999) The Impact of Changes in Exchange Rate on prices: A Case Study of Pakistan, The Pak Dev Rev 38: 4 Part 11, (PIDE Website)

- Choudhry E, Khan M (2002), The Exchange rate and Consumer Prices in Pakistan: Is Rupee Devaluation Inflationary?, The Pak Dev Rev 41:2 (Summer 2002) (IMF Website)

- Ahmed E, Ali S, (1999), Exchange Rate and Inflation Dynamics, The Pak Dev Rev 38: 3 (Autumn 1999( (PIDE Website)

|

|