Comparative Advantage

Although Adam Smith understood and explained absolute advantage, one big thing he missed

in The Wealth of Nations was the theory of comparative advantage. Most of the

credit for the theory is attributed to David Ricardo, although it had been mentioned a

couple years earlier by Robert Torrens.

The theory of comparative advantage is essentially the idea that even though one entity

may be better at producing a good than a second entity, it still may be beneficial to

trade with the second entity if they have lower opportunity costs. Comparative advantage

is most easily explained with an example.

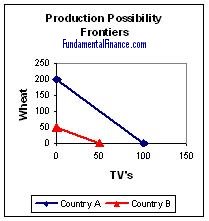

| Production Possibilities |

|---|

| Country A | Country B |

|---|

| Wheat | 200 | 50 |

| TV's | 100 | 50 |

Clearly Country A has an absolute advantage in the production of both wheat and TV's. In

the given time frame Country A can produce four times as much wheat or twice as many

TV's. If Country A were to devote half of its time to each good, it would produce 100

wheat and 50 TV's. If Country B were to devote half of its time to each good it would

produce 25 wheat and 25 TV's. This would be a combined total of 125 wheat and 75 TV's.

Now we must look at the opportunity costs. Country A must give up 2 wheat to produce

each additional TV, so the opportunity cost of 1 TV is 2 wheat for country A. Country B

only has to give up 1 wheat to produce an additional TV, so the opportunity cost of 1 TV

is 1 wheat for country B. Hence Country B can produce TV's cheaper (in terms of wheat)

than country A. Alternatively we could also say that Country A can produce wheat cheaper

(in terms of TV's) than Country B. This means that Country B should specialize in

producing TV's while Country A should specialize in producing wheat. This can also be seen by graphing the production possibility frontiers for the two countries and comparing slopes.

If the two countries still want 75 TV's between them but are now willing to trade, then

Country B should only produce TV's, which would yeild 50, and Country A should produce

the remaining TV's and then produce wheat the rest of the time, yeilding 25 TV's and 150

wheat. The total between them is now 150 wheat and 75 TV's, which is obviously better

than their outcome before trade. Country B is willing to trade 1 wheat or more for each

TV it produces and Country A is willing to trade 2 wheats or less for each of Country B's

TV's. They will settle at a price between 1 and 2 wheat for each TV. They can each get

the same amount of TV's as before and also have some extra wheat. That is a pareto

efficient move--everyone is better off and no one is worse off.

That example demonstrates comparative advantage and shows that trade can make everyone

better off. The assumptions are that there are no or low transaction costs, that there

are no negative externalities to more production, and that there are some restrictions on

the flow of capital. Comparative advantage is a critical concept for free trade

proponents.

Comparative advantage works as long as the above assumptions hold and the entities have

different production costs. In other words, if it costs both Countries A and B

2 wheat to produce an additional TV, then trade would not benefit them.

|