Price Floors

A price floor is the lowest legal price a commodity can be sold at. Price floors are used by the government to prevent prices from being too low. The most common price floor is the minimum wage--the minimum price that can be payed for labor. Price floors are also used often in agriculture to try to protect farmers.

For a price floor to be effective, it must be set above the equilibrium price. If it's not above equilibrium, then the market won't sell below equilibrium and the price floor will be irrelevant.

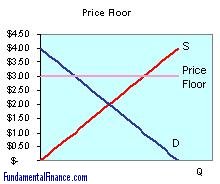

Drawing a price floor is simple. Simply draw a straight, horizontal line at the price floor level. This graph shows a price floor at $3.00. You'll notice that the price floor is above the equilibrium price, which is $2.00 in this example.

Drawing a price floor is simple. Simply draw a straight, horizontal line at the price floor level. This graph shows a price floor at $3.00. You'll notice that the price floor is above the equilibrium price, which is $2.00 in this example.

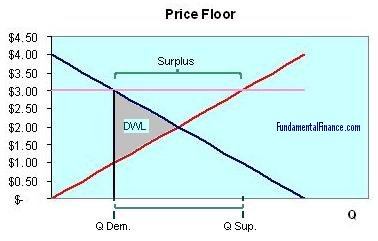

A few crazy things start to happen when a price floor is set. First of all, the price floor has raised the price above what it was at equilibrium, so the demanders (consumers) aren't willing to buy as much quantity. The demanders will purchase the quantity where the quantity demanded is equal to the price floor, or where the demand curve intersects the price floor line. On the other hand, since the price is higher than what it would be at equilibrium, the suppliers (producers) are willing to supply more than the equilibrium quantity. They will supply where their marginal cost is equal to the price floor, or where the supply curve intersects the price floor line.

As you might have guessed, this creates a problem. There is less quantity demanded (consumed) than quantity supplied (produced). This is called a surplus. If the surplus is allowed to be in the market then the price would actually drop below the equilibrium. In order to prevent this the government must step in. The government has a few options:

- 1. They can buy up all the surplus. For a while the US government bought grain surpluses in the US and then gave all the grain to Africa. This might have been nice for African consumers, but it destroyed African farmers.

- 2. They can strictly enforce the price floor and let the surplus go to waste. This means that the suppliers that are able to sell their goods are better off while those who can't sell theirs (because of lack of demand) will be worse off. Minimum wage laws, for example, mean that some workers who are willing to work at a lower wage don't get to work at all. Such workers make up a portion of the unemployed (this is called "structural unemployment").

- 3. The government can control how much is produced. To prevent too many suppliers from producing, the government can give out production rights or pay people not to produce. Giving out production rights will lead to lobbying for the lucrative rights or even bribery. If the government pays people not to produce, then suddenly more producers will show up and ask to be payed.

- 4. They can also subsidize consumption. To get demanders to purchase more of the surplus, the government can pay part of the costs. This would obviously get expensive really fast.

Although some of those ideas may sound stupid, the US government has done them. In the end, a price floor hurts society more than it helps. It may help farmers or the few workers that get to work for minimum wage, but it only helps those people by hurting everyone else. Price floors cause a deadweight welfare loss.

A deadweight welfare loss occurs whenever there is a difference between the price the marginal demander is willing to pay and the equilibrium price. The deadweight welfare loss is the loss of consumer and producer surplus. In other words, any time a regulation is put into place that moves the market away from equilibrium, beneficial transactions that would have occured can no longer take place. In the case of a price floor, the deadweight welfare loss is shown by a triangle on the left side of the equilibrium point, like in the graph. The area of the triangle is the amount of money that society loses.

A deadweight welfare loss occurs whenever there is a difference between the price the marginal demander is willing to pay and the equilibrium price. The deadweight welfare loss is the loss of consumer and producer surplus. In other words, any time a regulation is put into place that moves the market away from equilibrium, beneficial transactions that would have occured can no longer take place. In the case of a price floor, the deadweight welfare loss is shown by a triangle on the left side of the equilibrium point, like in the graph. The area of the triangle is the amount of money that society loses.

By B. Taylor, 2006

|

|