Monopolies

Market power sets monopolies apart from competitive firms. Market power is the ability of a firm to affect the market price. A firm in a competitive market doesn't have the ability to affect the market price since it holds a small share of the market and can easily be undercut by another firm. A monopoly exists when there is a single firm in an industry; it can change output to directly affect the market price.

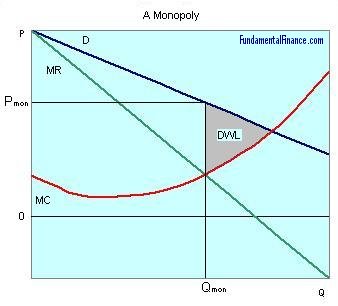

Because monopolies have market power, they have decreasing marginal revenue (assuming that all units in the market are sold for the same price). Since a competitive firm's output has no effect on market price, each additional unit a competitive firm produces yields revenue equal to the market price. Thus for a competitive firm, MR=P. When a monopoly produces an additional unit, it is increasing the quantity in the market and decreasing the market price (remember--monopolies have market power and competitive firms don't). The monopoly will gain the price the additional unit is sold for, but since there is a decreasing demand curve, the price of all the units in the market is reduced, and the monopolist will lose a fraction of revenue on every other unit. When computing a monopoly's marginal revenue, two things must be taken into account:

Because monopolies have market power, they have decreasing marginal revenue (assuming that all units in the market are sold for the same price). Since a competitive firm's output has no effect on market price, each additional unit a competitive firm produces yields revenue equal to the market price. Thus for a competitive firm, MR=P. When a monopoly produces an additional unit, it is increasing the quantity in the market and decreasing the market price (remember--monopolies have market power and competitive firms don't). The monopoly will gain the price the additional unit is sold for, but since there is a decreasing demand curve, the price of all the units in the market is reduced, and the monopolist will lose a fraction of revenue on every other unit. When computing a monopoly's marginal revenue, two things must be taken into account:

- 1. The price the marginal unit can be sold for.

- 2. The reduction in the price of all other units.

Given our assumption that all units in the market are sold for the same price, monopolies will always have MR

To profit maximize, a monopoly will choose to produce where MR=MC. This makes sense: a monopoly will continue to produce additional units of output as long as the revenue from each additional unit is greater than the cost of each additional unit, once an additional unit costs more than it can generate in revenue, the monopoly will stop producing.

Since the marginal revenue curve lies below the demand curve for a monopoly (MR

|